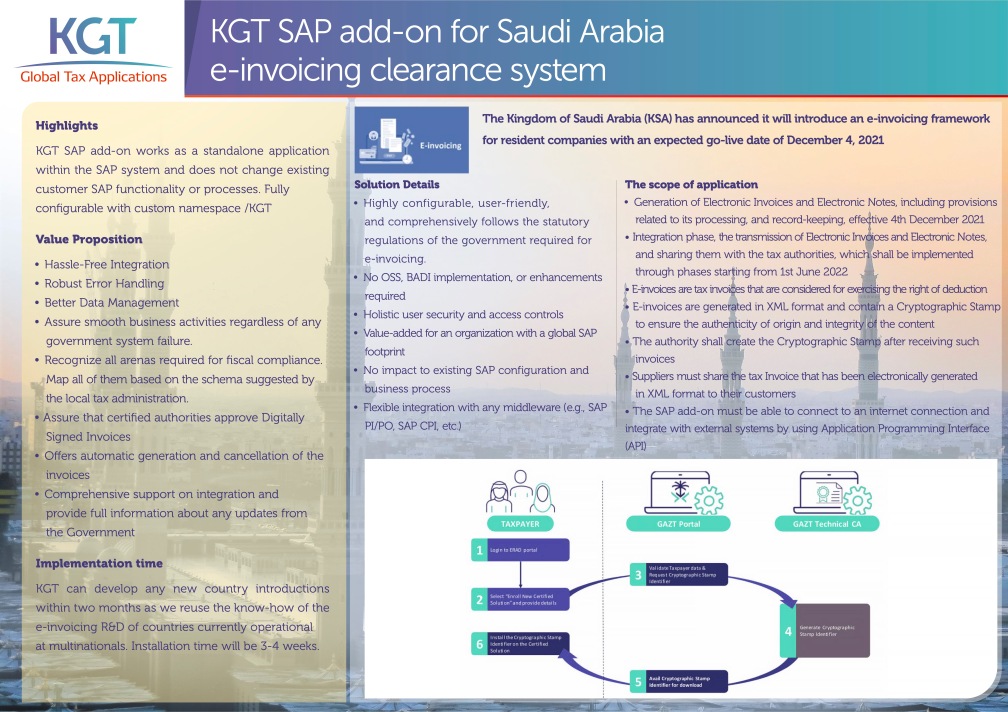

The Kingdom of Saudi Arabia (KSA) has announced it will introduce an e-invoicing framework for resident companies with an expected go-live date of December 4, 2021.

The announcement was published on December 4, 2020, and the Saudi authorities has released its details on the e-invoicing framework. That includes the system and technical requirements relating to the implementation of e-invoicing by businesses. That means we started, and we can develop quickly, as proven with our Egyptian SAP add-on solution, and install in around four weeks.

E-invoicing regulations are integral and complementary to the Value Added Tax (VAT) Implementing Regulations and apply to all taxpayers subject to VAT. The new regulations define the terms, requirements, and conditions related to electronic invoices.

KGT delivers a fully SAP-integrated solution to submit the requested tax data in an automated way. A turn-key SAP add-on that enhance standard SAP to timely submit tax reporting.