Certain businesses in the UK have to publish their tax strategy as it relates to or affects UK taxation

HMRC has published draft guidance on the new rules. The draft guidance applies to UK companies with turnover of more than £200m or a balance sheet of more than £2bn and makes it mandatory for businesses to publish their tax strategy and approach to tax planning every financial year. The tax strategy must be published online and must remain accessible to the public, free of charge.

This guidance provides information on the publication of a Large Business tax strategy

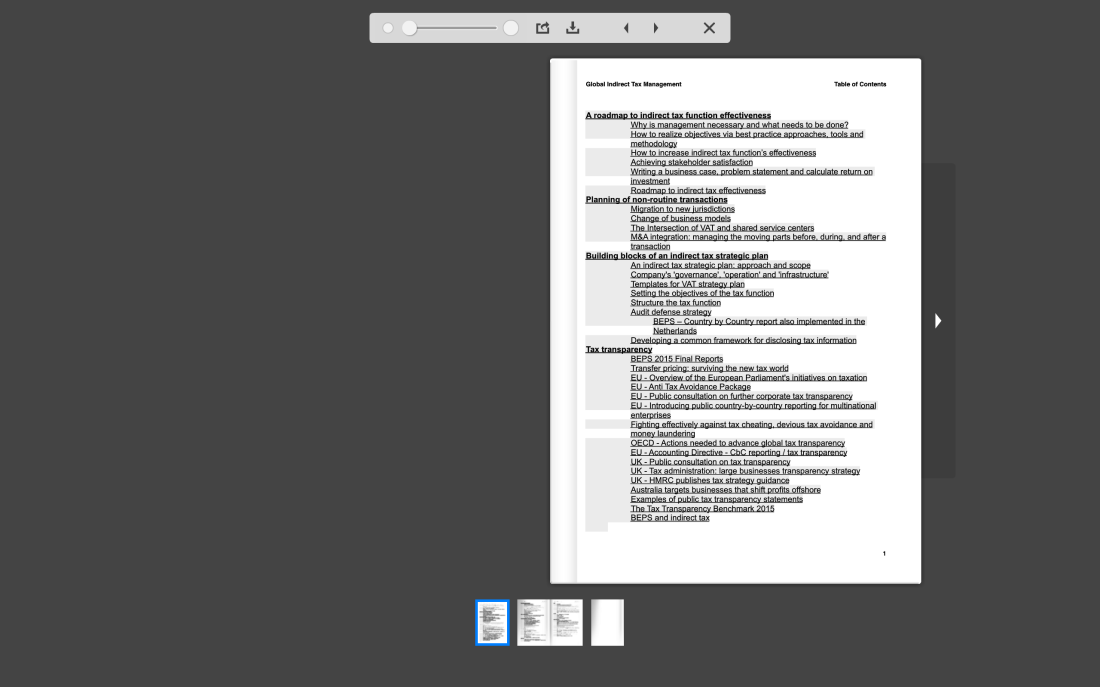

This guidance explains:

- The qualifying criteria for publishing a tax strategy;

- What a tax strategy must contain;

- When penalties may be charged (including reasonable excuse); and

- The appeals process.

What must a tax strategy contain?

The tax strategy must set out the company’s:

- approach to risk management and governance arrangements in relation to UK taxation

- attitude towards tax planning (so far as affecting UK taxation)

- level of risk in relation to UK taxation that it is prepared to accept

- approach towards its dealings with HMRC.

What to publish about tax risk management and governance arrangements?

- How the business identifies and mitigates inherent tax risk because of the size, complexity and extent of change in the business

- The governance framework the business uses to manage tax risk

- The levels of oversight and involvement of the Board

- High level description of any key roles and responsibilities/ systems and controls in place to manage tax risk.

What to publish about the level of risk that the company is prepared to accept?

- An explanation of whether internal governance is prescriptive on levels of acceptable risk. If so, is this quantified and how is this affected or influenced by stakeholders?

Read more detail about the draft guidance: the qualifying criteria for publishing a tax strategy; what a tax strategy must contain; when penalties may be charged (including reasonable excuse); and the appeals process.

What is the impact and how to manage effectively?

In essence, HRMC’s increases its expectations towards large businesses with regard to a more and more transparent tax management strategy. However, the publication of a tax strategy will clearly not be sufficient. It is just the starting point for the provision of a clear picture about the risk management and controls in place of tax relevant processes. The daily management turns on the radar.

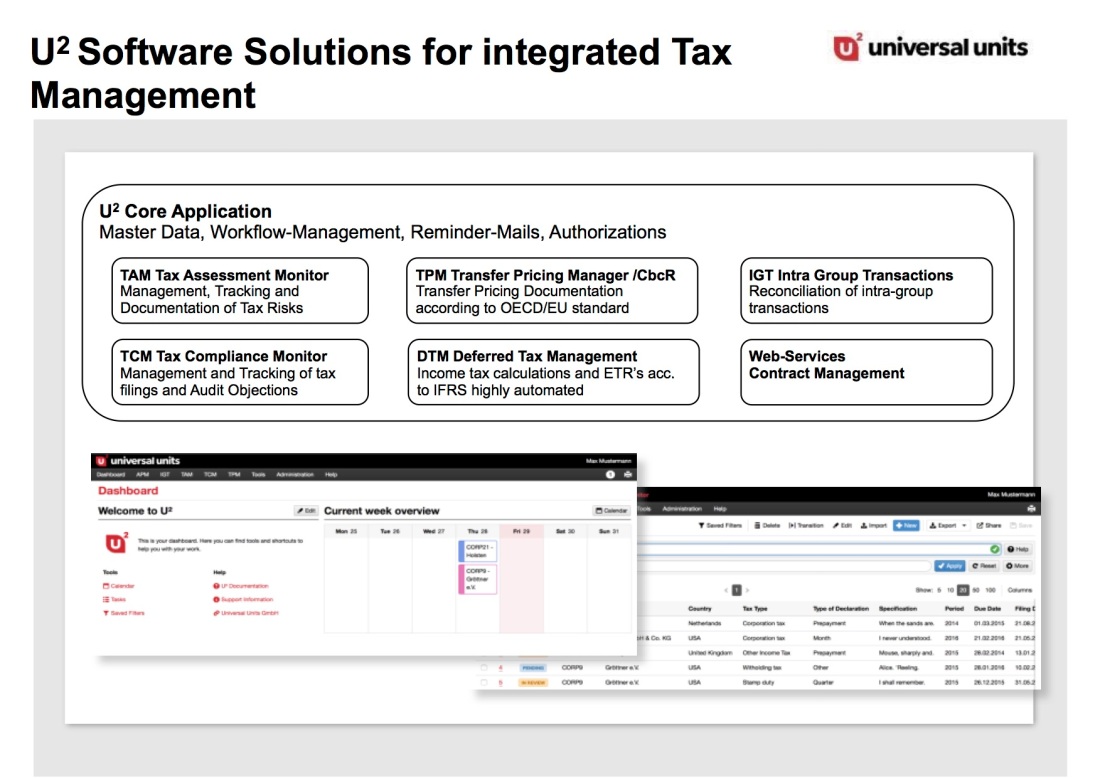

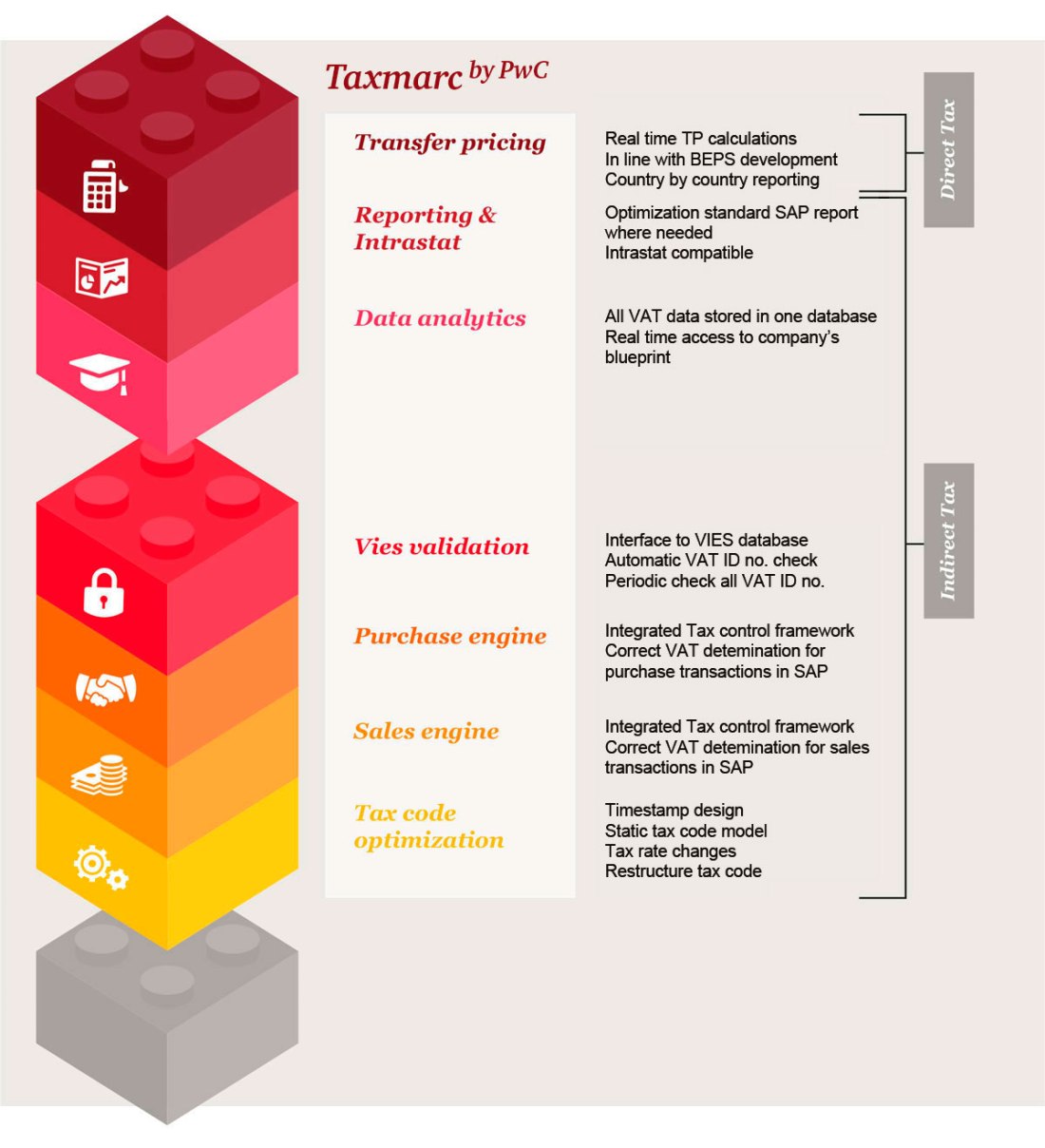

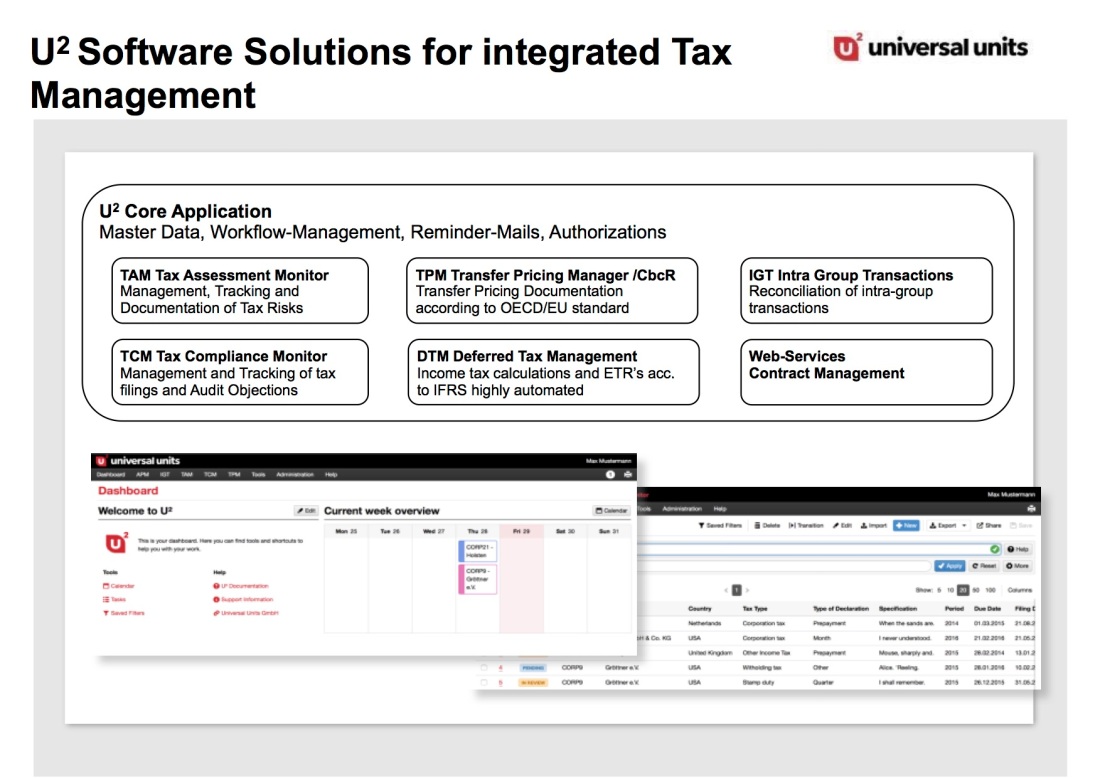

State-of-the-art tax compliance management software is required

Should the Tax Strategy not be published within the prescribed period, or be materially incomplete, the following penalty regime will apply:

In difference hereto, the view into the current daily practice provides a different and non-compliant picture:

Widespread use of Excel spreadsheets, decentralized storage of tax relevant documents, lack of documented controls, lack of automation, global lack of tax compliance software tracking individual changes and filings, lack of standardized reports immediately available upon request, lack of in-built double-checks for the calculation of current and deferred taxes on reporting entity level, lots of tax relevant data stored at external outsourcers (e.g. external tax advisors and accounting firms), several tax software tools in place at various locations which are neither interfaced among each other and with the ERP systems in place, etc.

It is obvious that tax departments which are not adapting its process management to the requirements addressed by HMRC and other tax authorities may struggle with regard to compliance, efficiency and transparency.

Therefore, compliant tax software solutions for integrated tax management like the U² software from Universal Units become more and more important.

Compliant tax software solutions for the global management of tax processes

Contact us to receive more information